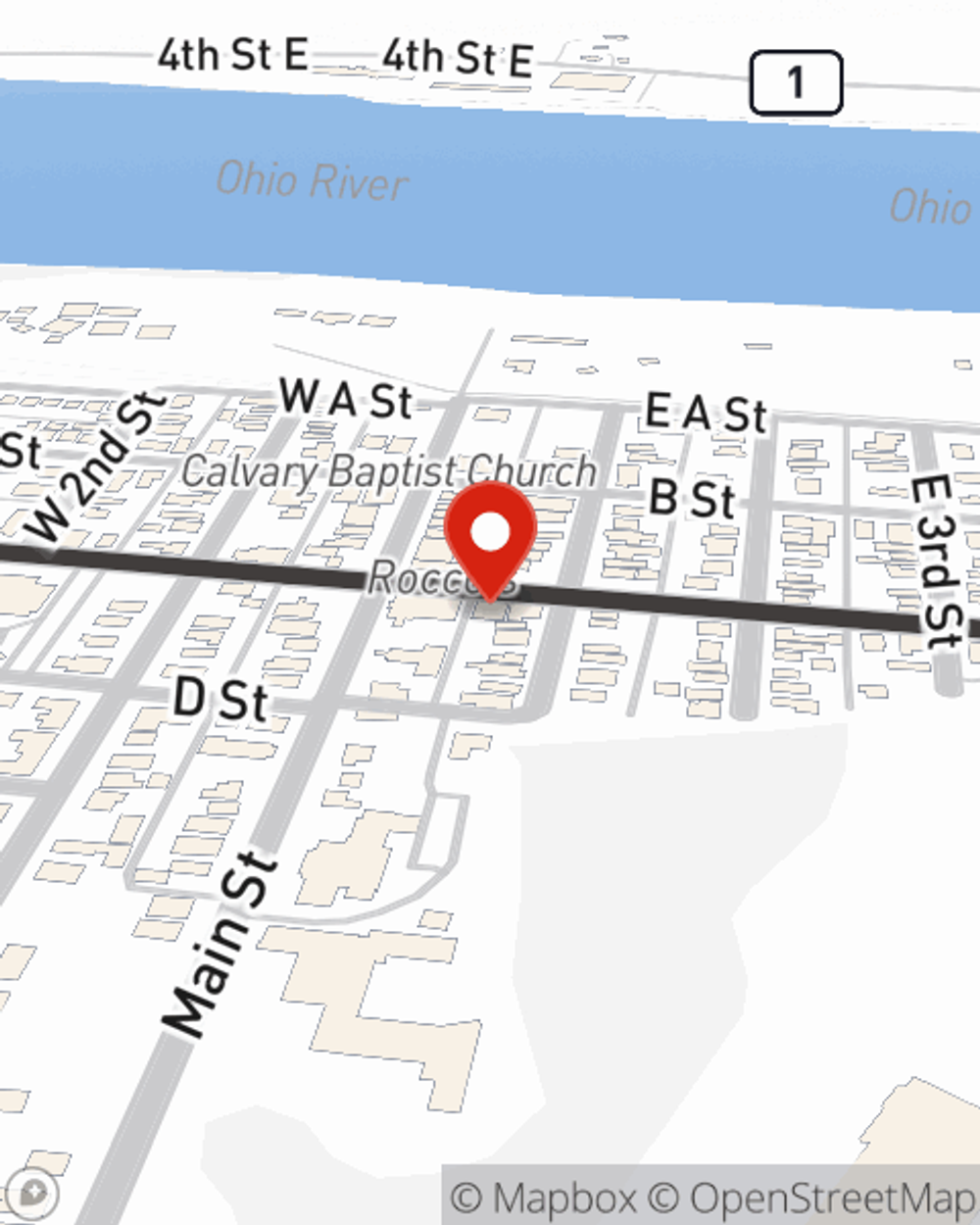

Homeowners Insurance in and around Ceredo

Ceredo, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This magnificent, secure homeowners insurance will help you protect what you value most.

Ceredo, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

For insurance that can help cover both your home and your valuables, State Farm has options. Agent Aaron Billups's team is happy to help you set up a policy today!

More homeowners choose State Farm® as their home insurance company over any other insurer. Ceredo homeowners, are you ready to learn more about what a company that helps customers by handling thousands of claims each day can do for you? Visit State Farm Agent Aaron Billups today.

Have More Questions About Homeowners Insurance?

Call Aaron at (304) 453-4600 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.

Aaron Billups

State Farm® Insurance AgentSimple Insights®

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.