Condo Insurance in and around Ceredo

Unlock great condo insurance in Ceredo

Protect your condo the smart way

Home Is Where Your Heart Is

When it's time to recharge, the home base that comes to mind for you and your loved onesis your condo.

Unlock great condo insurance in Ceredo

Protect your condo the smart way

Safeguard Your Greatest Asset

That’s why you need State Farm Condo Unitowners Insurance. Agent Aaron Billups can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Aaron Billups, with a no-nonsense experience to get reliable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Aaron Billups can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

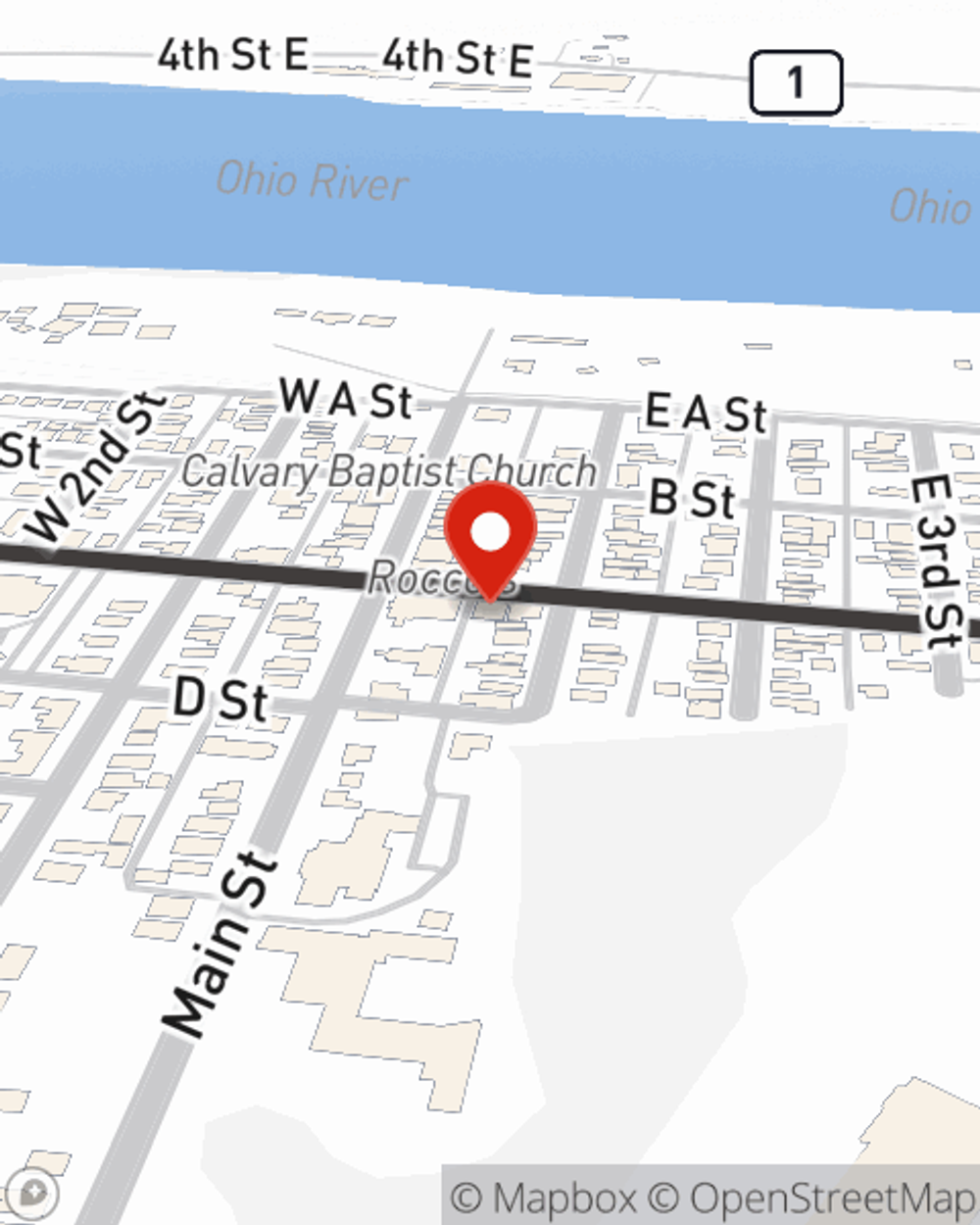

When your Ceredo, WV, condo is insured by State Farm, even if the worst comes to pass, State Farm can help insure your property! Call or go online now and find out how State Farm agent Aaron Billups can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Aaron at (304) 453-4600 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Aaron Billups

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.